Cpf contribution : Videos

Cpf contribution : Photo Gallery

Cpf contribution : Latest News, Information, Answers and Websites

CPF Board - Sitemap - my CPF 2

Know the CPF contribution rates. Know more about CPF Minimum Sum. Know more about ... CPF Contribution Calculator. Interactive Tutorial for Employers. CPF ...

CPF Board - Contribution Calculator

The CPF contribution rates effective from September 2011 will be updated in due course. Click to calculate CPF contributions for Singapore Permanent Residents. ...

Central Provident Fund Board (CPF)

Provides citizens with a comprehensive social-security savings scheme including retirement, home ownership, healthcare, and financial protection.

CPF Board - CPF Contribution Information - my CPF 2

Feb 11, 2009 ... Limits on CPF Contributions ... CPF Contribution and Allocation Rates ... CPF Contributions for Singapore Permanent Residents ...

how can we have a saving in our life? if our gross $1500/- after deduct cpf contribution might be abt $1200/-?

monthly need to pay:-

1.utilities average $150/-

2.sc/cc $51.60

3.house installment by cash $250/-

4.mother $150/- + prepaid 128 $26

5.petrol $90/-

6.daily pocket money $15/-

7.monthly courts installment $99/-X48mth

8.yearly IR8S $197/- property tax

9.6mths once for sevicing motor 4T Oil + spark-plug + Oil Filter for Honda Super4 $120/-net persession TOTAL $240/- + YEARLY MOTOR INSPECTION:-INSURANCE $189/-INSPECTION $17++, +Road TAX $132/- CHANGE FRONT&REAR TYRE $100each front tyre early change but rare tyre 18month

10.sickness THYROID around my neck from 2005 till 2008 but maybe abt the yrs not confirm tats was under speciallist N.U.H clinic D so was transfered to Jurong East Polyclinic for registration + medician almost $60/- per visit.

Answer: You need to cut your expenses or up your income and then you can save money. Possibly you could also do some sort of investing (ie the house payment is very slowly upping your equity in the house, but but a 2nd house and if you can rent it out with no loss then eventually you will own the 2nd house free and clear and can sell/ mortage it).

I know your expenses are high compared to your income but we all face these decisions every day. To increase your savings you must do whatever you need, to cut your expenses or increase your income (or possibly wise investing can save you).

Category: Renting & Real Estate

How to calcuate whether your salary reach $30,000 by cpf contributions (formnula)?

I understand that when you want to apply a credit card for the 1st time through citibank. They will want you to send them your 12 months cpf statement. But how they calcuate (formula) your cpf contribute whether you really reach $30,000? Pls show. Thanks!!

I mean the annual salary. Thanks you

Answer: The easiest way to show this is to submit your previous years income statement.

If you are in Singapore, perhaps you may wish to go to the following website. It is for DBS, but the same techniques would apply.

dbs.com/sg/personal/loans

/additionalinfo/faq/cpfsubmit/

I had to break the link in two to keep the system from erasing.

Category: Credit

CPF Board - Employers' Guide to CPF - my CPF 2

The employer has to pay the CPF contributions on the wages given by the employer and makeup ..... The rate of CPF contribution is dependent on 3 factors: ...

CPF Board - Contribution Calculator

You can calculate the CPF contributions payable for Singapore Citizens. The calculation can be made from July 2007 to August 2011. The CPF contribution ...

Explore FAQ

This is CPF PAL-Internet, the website of the Central Provident Fund Board, Singapore. ... How do I make a voluntary CPF contribution to my CPF Account(s) ...

Open Low-Power Methodology Ushers in New Era of Low Power Interoperability

AUSTIN, Texas--(BUSINESS WIRE)--Today the Silicon Integration Initiative (Si2) announced the contribution of key methodologies currently published in the CPF 2.0 Standard to the IEEE-1801 working group. This compilation of constructs is referred to as the Open Low-Power Methodology (OpenLPM), and is designed to greatly increase the degree of interoperability between the leading power intent ...

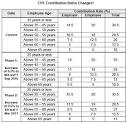

Revision in CPF Contribution Rates and Salary Ceiling ...

In short, the employer's contribution rate to the CPF will be raised by 0.5 – 15.5% to 16%. At the same time, the CPF Salary Ceiling will be increased from $4500 to $5000 per month to keep pace with income growth. ...

Leong Sze Hian » PAP Transformation Series – 13 suggestions to ...

13) Plug the loop-hole of some employers not paying the employer's CPF contribution for their part-time workers, such as part-time lecturers at the university, who go for reservist training. I would like to urge and call ...

Hello, if you make 220k in Singapore, how much is net AFTER your CPF contribution? Can anyone suggest a link?

If you suggest a link, please dont just suggest IRAS :) Thank you.

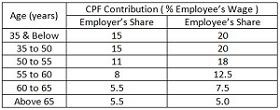

Answer: Employee's CPF contribution on your monthly gross salary is 20% and capped at an income ceiling of $4500. Which means, $900 maximum contribution from the employee's portion. For bonuses, it will be a straight 20% off your gross without ceiling (if I am not wrong). So let say you earned $17K a month, your monthly CPF contribution will be $900 x 12 mths = $10,800. If bonus is $17K, another additional $3400 will be added to your CPF.

IRAS is not the link to go. For CPF contribution, you should visit CPF website instead. Here is the link:

http://mycpf.cpf.gov.sg/Members/Calculators/mbr-Calculators.htm

Category: Personal Finance

Boleh! Boleh!: Your CPF Contribution Cap - Life of a Married ...

Alot of CPF members in Singapore might not even know that there is a salary cap to the CPF contribution for both employees and employers. Yes once your salary hit this amount, you and your employer do not need to ...

What do you think of the Budget measures set for 2011?

The Singapore Budget for financial year 2011 has just been unveiled. The government will provide a package of benefits for Singaporean households amounting to S$6.6 billion, set a personal income tax rebate of 20 percent and raise employer CPF contributions, among others. Do you think such measures will help improve your ability to cope with expected higher cost of living? What do you like or not like about the new Budget?

Answer: It is opportunistically an election budget out to buy votes from Singapore voters. The goodies given out to the men in the street are one-off measures and nothing significant or of long term basis.

The budget has no focus on unemployed Singaporeans to help them find decent jobs with decent remunerations. These unemployed Singaporeans could not find jobs in the employment markets due to influx of foreigners taking up most of the white/blue collars jobs formerly and traditionally filled by employable Singaporeans. Most Singaporeans would prefer stable jobs with decent monthly salaries on long term basis than to be given "goodies" on one-off measure basis.

Increaing foreign worker levy is for the category of foreign workers who are work permit holders. How about foreign talents, who are university graduates or have professional qualifications, under employment passes? This is the group that has taken up most of the jobs which traditionally employed mainly Singaporeans in the past.

If the budget does not do anything to help the unemployed Singaporeans to find jobs, then it is by all means a failed budget.

Category: Government

Central Provident Fund

The CPF contribution rate is adjusted according to the state of ... CPF contribution rates depend on a host of factors such as monthly income, age group, ...

CPF minimum sum to be revised upwards to S$131,000

SINGAPORE: From July, the prevailing CPF minimum sum (MS) will be revised upwards to S$131,000, up from S$123,000. The CPF Board said the new MS will apply to members who turn 55 from July 1 2011 to June 30 2012.

Boleh! Boleh!: Annual Bonus CPF Contribution Cap - Life of a ...

Since my last post on CPF Contribution Cap, some readers have been emailing me asking since there is a cap why is it that some months they actually contribute more than $900. So why is this so? ...

Are referrals employees of the company? Any CPF contribution for them?

All my questions are applied in Singapore only.

1. If a company pay somebody for referral fees as incentive for individuals, are those referrals/consultants considered as employee?

2. Any CPF contributions for them?

3. For those independant referrals, do they need to register as self-employed?

4. If referrals do not registered as self-employed, what are the implications for the company or employer?

Answer: If a referrals is employed under the company, then he/she will be the employees, and by law, there will be CPF contribution. But most of the time, it's just referral incentive as per referral, then you are consider as free lance, not consider a employee of the company. You will need to submit income tax as self-employed. As a self-employed, you need to contribute to CPF (medi-save account) as well.

Category: Other - Business & Finance

Budget 2007: Budget Speech 2007

4.4 First, we will raise the CPF contribution rate for employers. ... With the economy doing well, I believe we can sustain a modest rise in the employer CPF contribution rate. ...

Obits

Jeanie "Jeanne" Blaisdell Freeman Boyer , 101, formerly of Riverside, died on April 14, 2011 at her home in Mayflower Place in West Yarmouth, Mass. Boyer was born on Feb. 15, 1910 to Margaret and Frank Blaisdell in Bangor, Maine.

CPF Minimum Sum to be revised upwards to $131k

FROM July 1, the CPF Minimum Sum (MS) will be $131,000, up from $123,000 previously, the Central Provident Fund announced in a statement on Tuesday. The new MS will apply to CPF members who turn 55 from July 1 2011 to Jun 30 2012, those who can set aside the MS fully in cash can apply to commence monthly payouts of $1,170 when they reach their draw down age.

IRAS: Medisave/Voluntary CPF Contribution

You have to contribute to your Medisave account 30 days from the date you receive a "Notice of Computation for CPF Contributions (Medisave)" from IRAS. ...

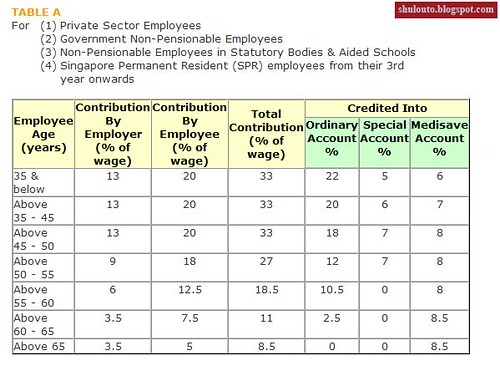

CPF Board - CPF Contribution and Allocation Rates - my CPF 1

Increase in employer CPF contribution rate by 0.5% to the Special Account. ... The new CPF contribution amount can be computed using the CPF Contribution Calculator or ...

EnterpriseOne - CPF Contributions

Oct 6, 2009 ... The Central Provident Fund Board (CPF Board) is in charge of collecting CPF Contributions. CPF is a comprehensive social security savings ...

Explore FAQ

For those who have set aside the full CPF Minimum Sum, the excess CPF contribution will be transferred from the Medisave Account to the Ordinary Account. ...

CPF Board - Members - Home - my CPF 1

Know more about CPF interest rates. Request a SingPass. Know more about my cpf Online Services. Know the CPF contribution rates. Know more about CPF Minimum ...

CPF Board - Members - Home - my CPF 2

Press Release on Changes in CPF Minimum Sum, Medisave Minimum Sum and Medisave Contribution Ceiling from 1 July 2011. CPF Interest Rate for Ordinary ...

IRAS: Medisave/Voluntary CPF Contribution

Medisave/Voluntary CPF Contribution. A partner or self-employed person ... Your combined compulsory CPF contribution as an employee and your compulsory ...

Increase in CPF Limits

The 40% who met their MS belonged to the high earners who were lucky to have a different formula for CPF contribution because contribution was higher. To succeed with the current formula will depend who you engage to ...

CPF Board - CPF Contribution and Allocation Rates - my CPF 2

For employees who are above 35 years old and earning monthly wages of less than $1500, the employer CPF contribution rates will continue to start from 0% at ...

CPF Board - Changes to CPF Contribution Rates - my CPF 1

Feb 9, 2011 ... To help Singaporeans save more for their medical and retirement needs, the Government will increase the employer CPF contribution rate by 1% ...

How and where should I invest to achieve maxinum returns?

I am 27years old and I have 18k in Ordinary Account and 10k in Special Account in CPF. My CPF monthly contribution is about $800 and have to service a $250 per month installatment for my HDB flat.

How and where should I invest to achieve maxinum returns.

Thanks!!

Answer: Anybody who gives you a specific answer is either lying or an idiot. If anybody could predict what will bring maximum returns, he would be too rich to read Yahoo.

First figure out what your accounts allow for investments - most people are not sure. For example, in the United States,

the IRA account allows pretty much everything except collectibles and some forms of gold - you can have real estate, debt, oil wells and lots of other things - but most people think they are limited to stocks, bonds, and mutual funds, because that's what they've been told - and never bothered to check.

Then review the investments and ask yourself:

a) what's the historic average rate of return for a given investment

b) what's a historically high rate of return for a given investment

c) what's a historically low rate of return ( how much can I lose in a year)

d) how complicated is it - putting money in a savings account is simple - trading stocks is complex, trading commodities increases the complexity by several factors

e) how much do I know about these investments,

and how much time do I have to learn about them -

remember: it takes about 10000 hours of study or work to be really good at something ( that's equivalent of 5 years of full time work).

People would not expect someone to take a weekend course and become a brain surgeon - why do people expect to learn

investing quickly and painlessly?

f) above all remember - protect your capital - ie: don't lose money! IF your investment goes against you - at what point will you sell it and preserve remaining capital - know this number before you invest, and stick to it religiously.

Category: Investing

Singapores Central Provident Fund | NewAmerica.net

CPF contributions up to the CPF Annual Limit (S$26,393 in 2008), and ... Table 1. CPF Contribution Rates and Allocation Among Accounts (for employees earning more ...

What are the standard employment laws in Singapore for PRs?

Are employers mandated to provide medical? How about leave and CPF contributions? And is there a differentiation between local and foreign companies?

Answer: CPF contributions for PR are subjected to individual's agreement with their company. It can be in full or progressive increment from year 1. If you plan to stay in Singapore long, it is a better idea to contribute in full from the beginning as this savings can help you when you need to purchase houses (whether it is private or public houses), not to mention the medisave which will definitely come in handy when you are hospitalized.

For medical, it is not compulsory for companies to provide them, it depends on the company you are working for, most time it is more like an fringe benefit on top of your salary. Likewise for leave, it can be anything from a few days to over 20 days per year, it depends on the company you are working for.

There are definitely differences between local and foreign own companies, but would be impossible to answer unless you narrow the scope down.

Category: Singapore

In SIN the employer contribution for cpf is paid frm employee sal/employer totally?Can sme be dducted frm sal?

Answer: Yes, it is paid by both!

No, !!!

Category: Singapore

everythinguneedtoknowoninsurance: CPF Minimum Sum to be revised ...

and the maximum balance a cpf member may have in his Medisave Account, also known as the Medisave Contribution Ceiling (MCC), is fixed at $5000 above the Medisave Minimum Sum and this will be increased to $41000 from ...

Central Provident Fund (CPF) - finatiQ

The Central Provident Fund (CPF) is a government-run social security scheme. ... From 1 July 2007, the total CPF contribution rates are 34.5% if you are below 50 years ...

Should employers CPF contributions be increased following Singapores strong economic data for Q1? Why?

Singapore’s labour chief has urged employers to consider restoring their portion of the Central Provident Fund (CPF) contributions following a strong rebound of the Singapore economy.

Do you think employers CPF contributions should be restored and what else can be done for employers?

Answer: Yes the employers' CPF contribution should be restored, as the employees has been supportive for the past few years. Since the economy has returned strongly, it's high time that the employees get back what originally belongs to them, the few percentage differences means significant to alot of people, especially those struggling to finance their homes.

Category: Economics

Is is possible to put in your own CPF if you have no CPF deductions?

If youre working in an agency which doesnt deduct your CPF, can you make your own contributions to your CPF when you get your pay?

Answer: Yes, you can do your own CPF contributions.

Category: Personal Finance

PAP Transformation Series – 13 suggestions to transform the CPF ...

The annual increment to CPF Medisave Contribution Ceiling must be reduced to its original amount S$1000.00. The former health minister took advantage of this, to liberalise the Medisave usage as he pleased. ...

tips on working in qatar? how do i settle hdb,cpf,ns matters?kids school overthere?

singaporean seeking employment in Qatar.Basically how do i go about in matters like hdb mortgage,cpf contribution, ns and any ideas on family environment over there(children education or spouse possible employment)

Answer: I worked in Doha for 2 weeks...couldn't wait to get out. It sucks!!!

Category: Financial Services

can temp staff not have cpf contributions? if no, what is the min salary to have CPF contri?

the temp staffs do not get their pay monthly; meaning they get it weekly or fortnightly or every 3 weeks. each weeks salary is ard $250.

Answer: This is a matter of company policy, isn't it? Usually, part time, temp and entry level are offered less than needed to be offered benefits.

Category: Financial Services

Central Provident Fund - Wikipedia, the free encyclopedia

The Central Provident Fund (Abbreviation: CPF; Chinese: 公积金, Pinyin: ... In September 2010, the employers contribution to the CPF, a national pension fund, will ...

can i terminate my contract with the company if the company keep delaying contribution of cpf?

Answer: I believe so

Category: Law & Legal

CPF minimum sum to be raised to $131,000

SINGAPORE - The CPF minimum sum will be revised upwards to $131,000 from the previous $123,000 from July 1, announced the Ministry of Manpower (MOM) in a statement on Tuesday.

Singapore Central Provident Fund (CPF) Contribution Rates ...

Singapore Central Provident Fund (CPF) Contribution Rates ... Allocation of CPF Contributions. The CPF contributions are allocated to the Ordinary, ...

For CPF contribution, what is the minimum pay I must get so that my boss will pay me CPF?

I am from Singapore.Thanks!

Answer: There is no minimum salary for CPF contribution from employer. Employer has to pay the employer’s and employee’s share of CPF contributions monthly for all employees at the rates set out in the CPF Act.

Category: Administrative and Office Support

CPF Board - Changes to CPF Contribution Rates - my CPF 1

Changes to CPF Contribution Rates. To help Singaporeans save more for their medical and retirement needs, the Government will increase the employer ...

IRAS: Medisave/Voluntary CPF Contribution

Medisave/Voluntary CPF Contribution. For sole-proprietors/self-employed (freelancers, ... Your combined compulsory CPF contribution as an employee and your ...

Are workers under contract for service eligible for EPF contribution in Malaysia?

In Singapoe there is a difference between contracts of service and contracts for service. The latter is exempted from CPF contribution. I am not sure if the same is also true for Malaysian in Malaysia.

Answer: There are some types of occupations that requires compulsory EPF contribution, and some optional. But everyone who is working can have an EPF if one wants too.

Category: Other - Taxes

Cancelation of Singapore PR status from India?

I am a Singapore PR but presently working in India, I would like to cancel my PR status and collect my CPF contribution and left over amount in DBS bank, PR status will expire in 2011. My question is can I able to cancel my Singapore PR status from India without visiting CPF office in Singapore? If so please let me know where to go for the cancelation in India.

Answer: try singapore embassy in india

Category: Singapore

Retail Sales Promoters - Fulltime Position | Singapore Job

CPF contribution is applicable. Basic salary per month is $1000. Retail Cashier Responsibilities :Process customers purchase transactions in the outlet using POS cashier system. Working hours: 6 hours per day. ...